- Best Overall Identity Security

- Financial, Credit, and ID Monitoring

- Up to $3M Identity Theft Coverage

- Save Up to 52% Off

- Best for Flexibility

- Backed by TransUnion

- Excellent Business Solutions

- Mobile Security with App

- Best Protection Guarantee

- Guaranteed ID Restoration

- Up to $1M in Cost Reimbursements

- Backed by LegalShield

Identity Theft Protection: Our Security Expert’s Perspective

Identity theft protection is an essential service that comprehensively safeguards your personal and financial information against the ever-evolving threats of identity theft. It offers proactive monitoring, detection, and resolution measures, minimizing your risk of identity theft. Here are the main vulnerabilities that most services protect against:

- Financial fraud: It monitors your credit reports, bank accounts, and credit card activities to identify unauthorized transactions and prevent financial losses.

- Social security fraud: It safeguards your social security number (SSN) from being fraudulently used for employment, government benefits, or other purposes.

- Non-credit related fraud: It extends protection to areas like healthcare records, tax filings, and fraudulent use of personal information in non-financial transactions.

- Identity restoration: It provides expert assistance in case of identity theft, including help with resolving fraudulent accounts and restoring your identity.

To ensure comprehensive protection, consider a reliable identity theft solution and review the top providers listed below to find the right protection for you. Don't wait; enroll now and secure your personal and financial information before it's too late.

Exclusive Offer On Our Top Rated Provider

Up to 52% Off

- Best Overall Identity Security

- Financial, Credit, and ID Monitoring

- Up to $3M Identity Theft Coverage

- Save Up to 52% Off

Specs

- Dark Web Monitoring Yes

- Credit Monitoring Yes

- Data Breach Alerts Yes

- Max Coverage $3 million/adult; $1.05 million/child (includes reimbursements)

- Individual Monthly Plans Starting at $7.50

- Family Monthly Plans Starting at $12.50

- Free Trial 30 days

Summary

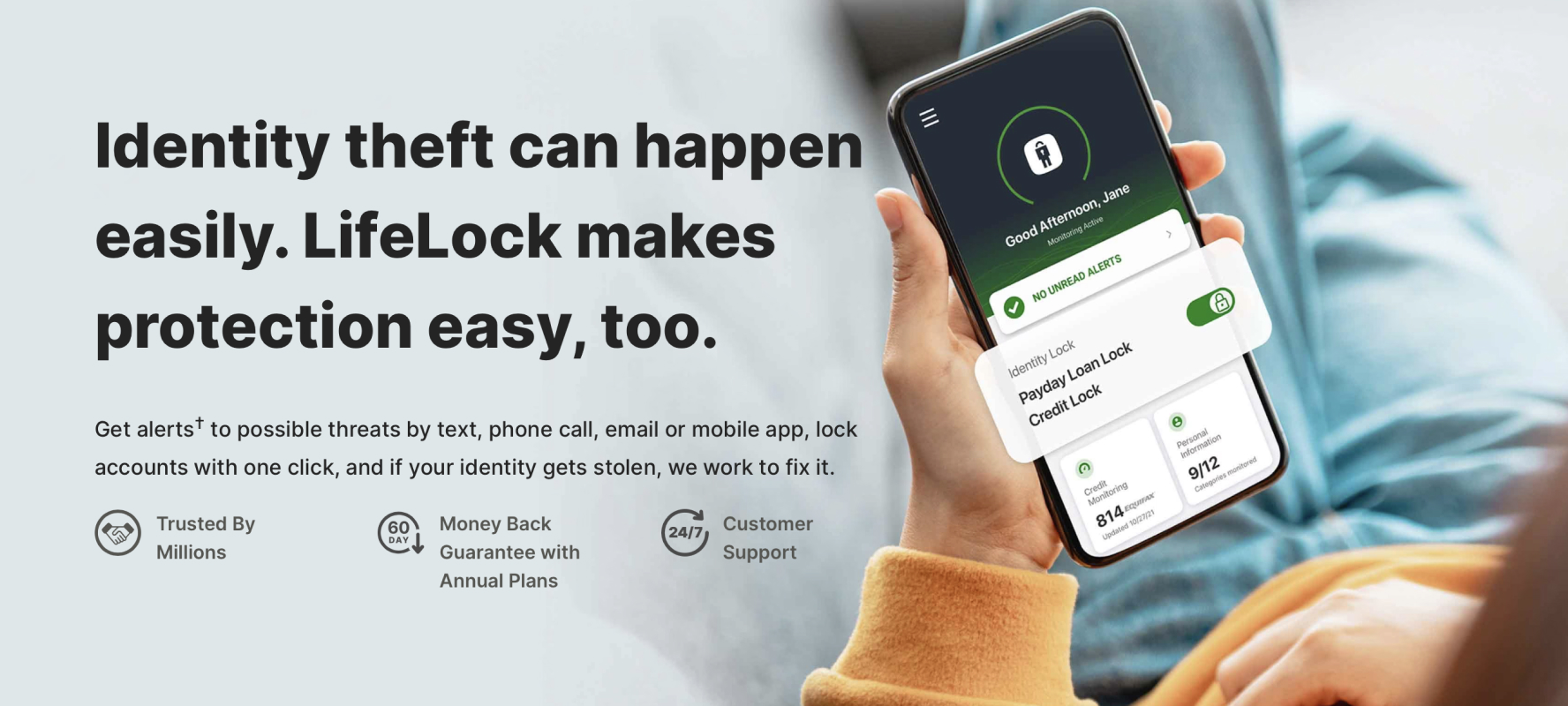

Since its 2005 founding, LifeLock has steadily built a reputation as the gold standard of identity theft protection. It's now a part of NortonLifeLock, a global leader in consumer cyber safety. Thanks to its affiliation with Norton, you can choose whether to bundle your identity theft protection plan with antivirus and VPN services.

Even if you choose the most basic identity theft protection plan, you still receive advanced digital security features beyond traditional services, including 24/7 member support and access to U.S.-based identity restoration specialists.

LifeLock's service has three pillars:

- Meticulous & comprehensive personal account monitoring

- Instant alerts for potential breaches

- Support during identity recovery post-breach

Lifelock keeps a close eye on top hotspots for identity theft, which include:

- USPS address alterations

- Criminal registries

- Court documentation

- Dark web activities

- Data breach notifications

The cornerstone of LifeLock's identity management is the Privacy Monitor. This advanced technology searches various private forums and data broker sites for your personal details and alerts you of potential identity threats.

That dedicated vigilance continues with credit and financial monitoring, which varies by subscription level. The first and second member tiers include one-bureau credit monitoring, while the top level offers three-bureau credit monitoring with daily updates. Most plans also allow users to activate a credit and payday loan lock with a single click from the LifeLock dashboard.

Regarding finances, LifeLock's two higher-level membership plans offer bank account monitoring and suspicious activity alerts. The top tier includes advanced features to help protect bank accounts, investments, and 401K plans.

LifeLock doesn’t stop with monitoring; its support extends to identity theft mitigation. If a member falls victim to identity theft, LifeLock's dedicated specialists help them navigate the complex recovery process. Every LifeLock plan includes comprehensive insurance coverage, offering a financial buffer against potential losses.

Even with all these features, Lifelock offers user-friendly software, both online and on the app. It sends suspicious activity alerts immediately via text, phone call, or email—whatever is best for you.

What We Like

- Comprehensive financial, credit, and identity monitoring

- Up to $3 million identity theft reimbursement coverage

- 24/7 monitoring

- Real-time fraud alerts

- Personalized identity restoration support

- Up to three credit bureau scores and reports

- One-click credit lock

- Affordable first-year options

What We Don't Like

- Advanced coverage only available in top-tier membership plans

- Must upgrade to Norton 360 with LifeLock to add cybersecurity protection features

Pricing

LifeLock offers individual, couple, and family plans, each with three possible tiers: Standard, Advantage, and Ultimate Plus. The exact costs depend on the membership, tier level, and payment plan (paid monthly or annually). These diverse plans offer you the flexibility to choose the most cost-effective options and you can save up to 52% on your membership. Here are the first-year costs for the different plan options.

Individual Plans:

- LifeLock Standard $7.50/month paid annually ($11.99/month paid monthly)

- LifeLock Advantage $14.99/month paid annually ($22.99/month paid monthly)

- LifeLock Ultimate Plus $19.99/month paid annually ($34.99/month paid monthly)

Family Plans (two adults):

- LifeLock Standard $12.49/month paid annually ($23.99/month paid monthly)

- LifeLock Advantage $23.99/month paid annually ($45.99/month paid monthly)

- LifeLock Ultimate Plus $32.99/month paid annually ($69.99/month paid monthly)

Family Plans (two adults and five kids):

- LifeLock Standard $18.49/month paid annually ($35.99/month paid monthly)

- LifeLock Advantage $29.99/month paid annually ($57.99/month paid monthly)

- LifeLock Ultimate Plus $38.99/month paid annually ($79.99/month paid monthly)

Note that bundled plans (LifeLock plus Norton 360) cost slightly more, with individual plans starting at $8.29 per month for the first year.

Bottom Line

Even at the Standard Level, LifeLock provides a mix of comprehensive monitoring, substantial insurance, and proactive device prevention. Combine that with its top-tier reputation, varied plan and price options, and user-friendly interface, and it's no wonder why LifeLock is ranked as the best of the best.

Visit LifeLock Website

Specs

- Dark Web Monitoring Yes

- Credit Monitoring Only with top tier

- Data Breach Alerts Yes

- Max Coverage $1 million

- Individual Monthly Plans Starting at $17.99

- Family Monthly Plans Prices not available; must call for a consult

- Free Trial 30 days

Summary

IdentityForce offers about 40 years of experience in identity theft protection. If that experience wasn't enough, the brand is backed by TransUnion, one of the three main credit bureaus.

Because of its connection to TransUnion, you might expect that credit monitoring—at least from TransUnion—comes with all member plans. Unfortunately, it does not. You can only get credit monitoring with the top-tier plan, but at least it includes reports from all three credit reporting agencies.

Credit aside, IdentityForce includes four main pillars of protection:

- Monitor

- Alert

- Control

- Recover

No matter the plan, you can get fraud, dark web, payday loan, and social media identity monitoring, plus threat and suspicious activity alerts. All plans also include access to a mobile app, medical ID fraud protection, and fully managed restoration after a breach. If you want things like a credit freeze, mobile phone threat detection, or a secure VPN, you will have to pay for the advanced plan.

Perhaps one of the biggest selling points of IndentityForce is its flexibility with unique membership plans. In addition to the two individual plans highlighted on the website, the company offers customizable family and business plans. For example, companies can offer an IdentityForce membership as an employee benefit that keeps workers happy and safe.

The only issue is that IdentityForce doesn't list family or business prices—only individual plans. Hidden prices are never ideal and usually mean high per-person costs. Businesses might be able to manage these costs, but they can easily become unreasonable for a family looking for cost-effective protection plans.

That said, IdentityForce does offer child identity theft protection as a paid add-on option for any individual plan. Called ChildWatch, this service can help you protect any child under 18 by offering the following:

- Social media, identity, and child credit activity monitoring

- $1 million in insurance coverage

- Fully managed restoration

The downside is that you have to pay extra per child, which further hints at the high costs of an entire family plan.

What We Like

- Backed by TransUnion

- Four-pronged approach to identity theft protection

- Business solutions and employee benefits available

- Mobile security with app

What We Don’t Like

- Slight pricing discrepancies on the website

- Family and business pricing not publicly available

- High prices for simple plans

- Child protection costs even more—per child

- Limited insurance coverage even with top plan

- Credit monitoring only available with top plan

Pricing

IdentityForce offers two main membership plans for individuals: UltraSecure and UltraSecure+Credit.

- UltraSecure: $17.99/month (or $179.90/year—two months free)

- UltraSecure+Credit: $23.99/month (or $239.90/year—two months free)

Note that IdentityForce offers family and business plans, but you must call in for a price consultation—which usually means much higher prices. As a compromise, you can add the ChildWatch service onto either individual plan, but it costs an additional $2.75 per child.

Bottom Line

IdentityForce offers comprehensive plans, but they're expensive, and you have to pay extra for services like a secure VPN or child protection. That's why it's likely not the best for individuals and families, but rather businesses.

Visit IdentityForce Website

Specs

- Dark Web Monitoring Yes

- Credit Monitoring Yes

- Data Breach Alerts Yes

- Max Coverage $1 million (not insurance, but reimbursements)

- Individual Monthly Plans Starting at $14.95

- Family Monthly Plans Starting at $29.95

- Free Trial 30 days

Summary

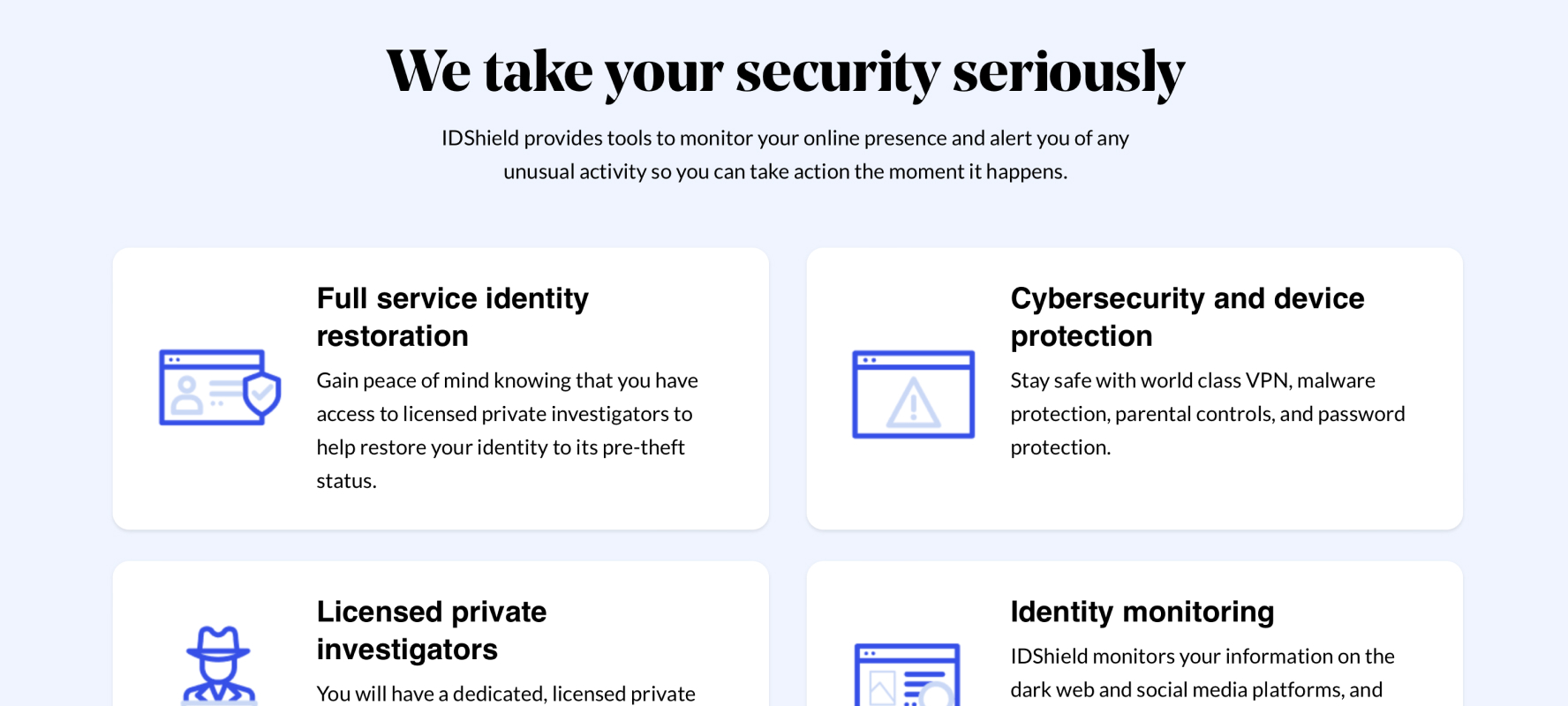

IDShield forms part of LegalShield, a subscription-based legal service with over 40 years of experience. Because of this connection, IDShield offers access to licensed private investigators, all based in Oklahoma. These professionals offer full restoration services to members that fall prey to identity theft.

While that is an obvious draw, private investigators are not the same as identity restoration specialists. It raises the question of whether a PI can offer the same restoration services that a specialist can.

Private investigator services aside, IDShield offers guaranteed identity restoration with 24/7 emergency assistance. It also provides up to $1 million in cost reimbursements, but it's unclear whether that is per person or total.

The other core services include financial, identity, and device protection. Here is an overview of the available features:

- Dark web monitoring

- SSN tracking

- Minor child monitoring

- Social media scanning

- Credit freeze

- Payday loan monitoring

- Sex offender tracking

- Mobile device virus protection

- VPN protection

- Password manager

While that's certainly a comprehensive list, there are some core financial pieces missing—mainly 401K and investment monitoring. The financial features focus mainly on credit monitoring, but members only get reports from one credit bureau at the most basic plan level.

What We Like

- 24/7 emergency support

- Simple pricing plans

- Same core features across plans

What We Don’t Like

- No 401(k) or retirement account monitoring

- Live chat feature doesn't work

- Limited plan tiers and options

- No discounts for annual prescriptions

- Support from a private investigator instead of identity restoration specialist

Pricing

IDShield offers two plan options: individual and family. Within each category, you can choose either one- or three-bureau credit monitoring. All the other features in the plans are the same.

- Individual Plan $14.95/month (one bureau); $19.95/month (three bureaus)

- Family Plan $29.95/month (one bureau); $34.95/month (three bureaus)

Bottom Line

IDShield is fairly affordable with decent coverage, but it has limited plan options and features. The biggest selling point is the private investigator support—if you prefer that over an identity restoration specialist.

Visit IDShield Website

Specs

- Coverage for five devices and up Yes

- Antivirus, malware, ransomware, and hacking protection Yes

- 100% Virus Protection Promise Yes

- 50GB Cloud Backup Yes

- Password Manager Yes

- VPN private internet connection Yes

- Dark Web Monitoring Yes

- Privacy Monitor Yes

- Parental Control Yes

Summary

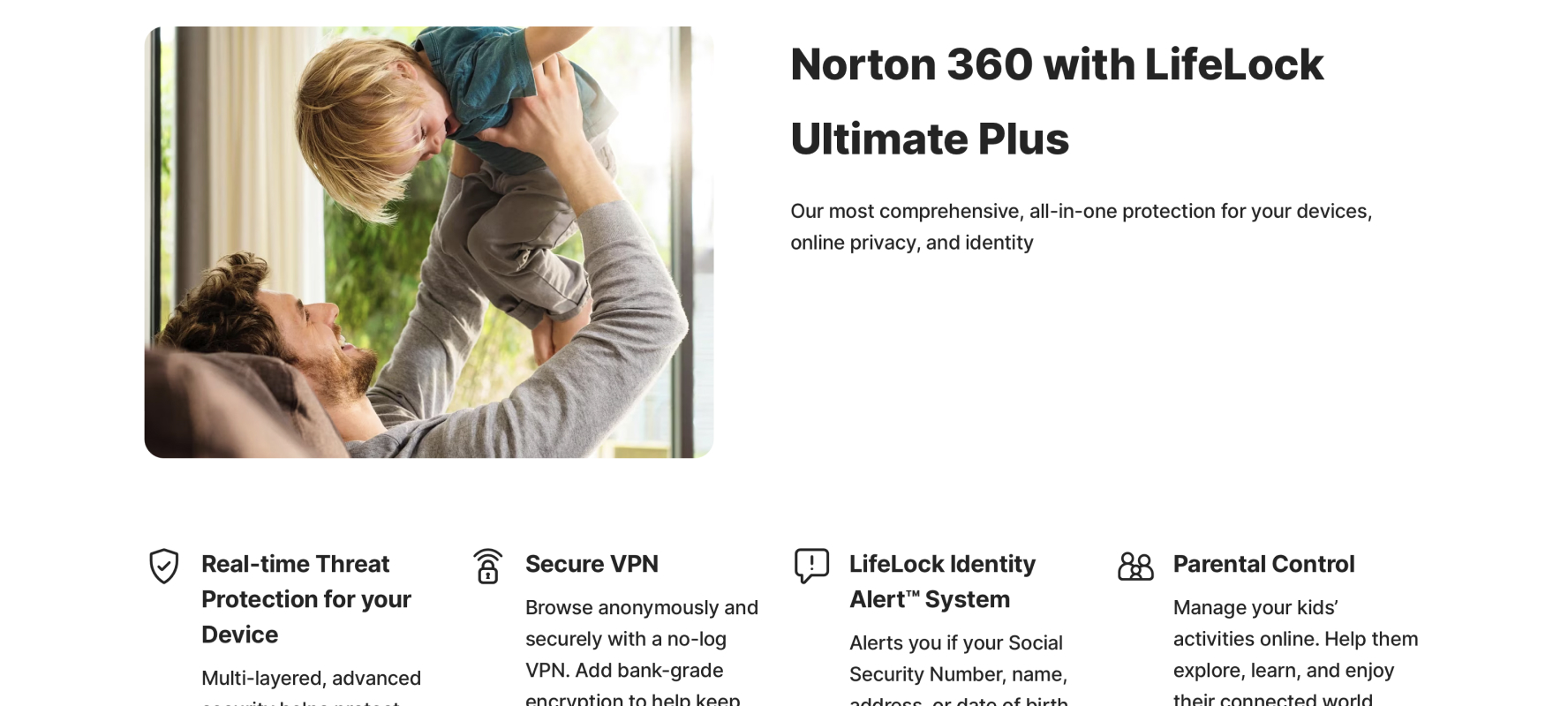

We’ve covered Lifelock, which continues to be a market leader in identity theft protection. But users can also gain additional protection through Lifelock’s strategic partnership with Norton, a renowned antivirus brand. Norton is one of the longest-running online consumer safety and security brands. Combining its robust digital software security with Lifelock’s monitoring features provides a comprehensive shield for your personal data.

Although these two prominent companies have merged, you can still purchase Lifelock-only plans. But if you want to take advantage of the merger, Norton 360 plus Lifelock plans are available that bundle Norton 360 with each tier.

In all honesty, bundling these services together makes a lot of sense if you’re looking for the best identity theft protection. Norton’s antivirus software is one of the best in the business. And combining it with the thorough monitoring Lifelock gives you one of the most comprehensive protections on the market.

The main benefit of Norton is its proactive digital protection. It offers excellent real-time protection, has high-level malware detection rates, and is possibly the most feature-rich antivirus software on the market. It includes:

- Secure VPN with no bandwidth limits

- Malware and virus scans

- Smart Firewall

- Real-time threat protection

- Password Manager

- Ransomware

- Hacking protection

- System Optimization

Norton’s malware protection is borderline untouchable. It has a long history of near-perfect virus detection results. A recent Independent IT-Security Institute AV-tes scored Norton the maximum of 6 points in performance, protection, and usability.

That means Norton’s virus protection features caught 100% of zero-day malware, detected no false positives, and had less impact on computer speed than many other antivirus programs.

It also comes with one of the most user-friendly interfaces in the industry. Both the desktop and app have a clean design and are highly navigable. It’s very easy to find features and utilize them in real-time. All plans also feature 24/7 live support, which is reassuring. Finally, each package offers a 30-day free trial and a 60-day money-back guarantee, which is hard to beat.

What We Like

- Secure VPN and password manager

- 100% protection against all forms of malware

- Excellent digital security protection

- Supports Windows, macOS, Android, and iOS

- Clean and user-friendly design

- Excellent mobile app

- Parental control features

- 24/7 live support

- 30-day free trial and 60-day money back guarantee

What We Don’t Like

- Plan options can be a little overwhelming

- Price jump after the first year

Pricing

- Deluxe $49.99 annually for the first year

- Select + LifeLock $9.99 (or $8.33 discounted annually)

- Advantage + LifeLock $19.99 (or $15.99 discounted annually)

- Ultimate Plus + LifeLock $29.99 (or $24.99 discounted annually)

Bottom Line

Norton 360 is one of the best digital security software out there. Combining it with Lifelock creates one of the market's most comprehensive monitoring packages. The wealth of package options can feel overwhelming, but finding the right one is worth the time and energy. Also, right now, their packages are up to 56% off. So, now’s a good time to consider trying them.

Visit Norton Website

Specs

- Dark Web Monitoring Yes

- Credit Monitoring Yes

- Data Breach Alerts Yes

- Max Coverage $1 million—only for paid plans

- Individual Monthly Plans Starting at $0

- Family Monthly Plans Starting at $34.99

- Free Trial 30 days

Summary

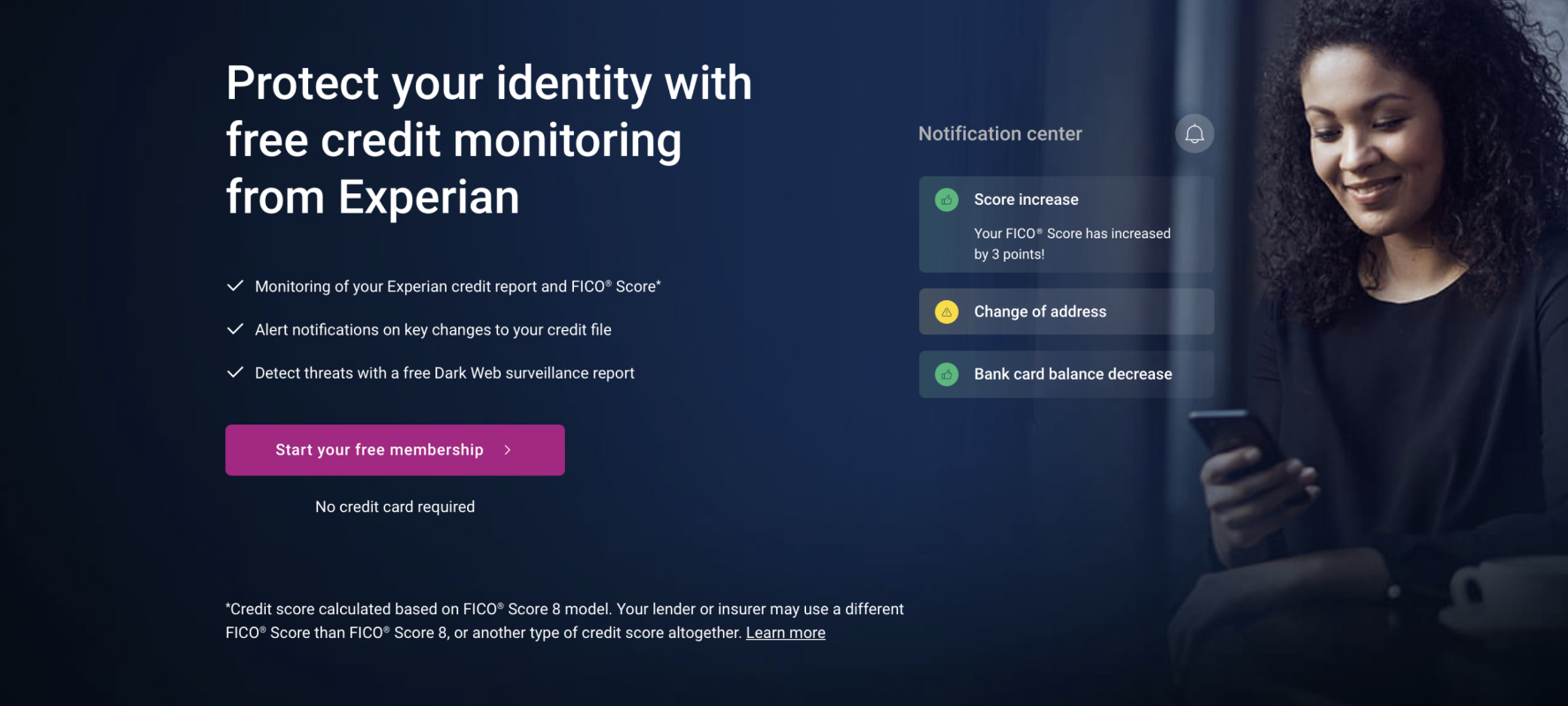

Experian is the largest of the three reporting credit bureaus, bringing much experience and respect. So, it makes sense that Experian has expanded into the identity theft protection sector with its Experian IdentityWorks plans.

Since Experience is a credit bureau, its identity protection plans focus heavily on credit monitoring. In fact, its most basic (and free) plan offers a FICO Score tracker and Experian credit monitoring—plus basic dark web surveillance and a privacy scan.

To get any more in-depth identity protection features, you have to choose a paid plan. Both the individual and family plan options include advanced credit monitoring features, such as the following:

- Three-bureau credit monitoring and alerts

- Daily FICO scores from Experian

- Experian CreditLock with Alerts

The paid plans also include basic financial and identity protection features, such as:

- Dark web surveillance alerts

- Sex offender registry alerts

- Financial account takeover alerts

- Social Security number tracing

- Social media monitoring

- Monthly privacy scans

- Fraud resolution support

These are all standard features for identity theft protection services, and there's nothing quite extraordinary here. There's no investment account monitoring or device protection and only identity monitoring for children in the family plan, nothing else. Plus, customer service options are limited. The only way to report and respond to identity theft is to call in and deal with the automated service.

What We Like

- In-depth credit monitoring features

- Daily credit score updates in paid plans

- Free credit monitoring account option

What We Don’t Like

- Limited financial and identity protection

- Few child protection options, even in the family plan

- Only two paid plans

- High prices, considering the few identity protection features

- Restricted customer service options

- No annual payment discount

Pricing

Experian offers three plans, each one focusing on credit monitoring. The basic and premium options cover one individual, while the family plan includes two adults and up to 10 kids.

- Experian Basic Free

- Experian Premium $24.99/month

- Experian Family $34.99/month

Bottom Line

Experian is great at what it does: credit monitoring. If you want a comprehensive, balanced protection plan, look elsewhere; if you're mainly concerned about credit monitoring, Experian is a great option.

Visit Experian Website

Specs

- Dark Web Monitoring Yes

- Credit Monitoring Yes

- Data Breach Alerts Yes

- Max Coverage $2 million (plus expense reimbursements)

- Individual Monthly Plans Starting at $9.07

- Family Monthly Plans Starting at $16.49

- Free Trial 30 days

Summary

Allstate is a highly respected insurance company with nearly a century of experience. It recently founded its Allstate Identity Protection services with fairly competitive insurance coverage—understandably.

However, we must note a few limitations. First, there's no personal expense reimbursement in lower plans nor lost wallet protection in the lowest level. The $2 million coverage is also limited to the top-tier family plan, not individuals. That's also the limit for a group of up to 10 people, which means it doesn't reimburse much per person.

Nevertheless, Allstate does offer some unique features. For example, it focuses on educational resources to help people avoid fraud. The Elder Fraud Center, in particular, offers informative articles, a step-by-step guide to facing scams, and a 24/7 elder fraud hotline.

The Digital Footprint tool is also helpful, providing a comprehensive look at where member information lives online. You can track company accounts you've forgotten about or identity vulnerabilities all within your Allstate Identity Protection account. The downside is that the Digital Footprint is only available in the top two plans.

Speaking of plan limitations, the so-called Essentials plan lacks several essential features like address change monitoring and lost wallet protection. You also need to invest in the highest tier package to get any type of cybersecurity monitoring. Moreover, the family plans don't offer specific child protection services. It seems that the added price is only for covering additional people, not special features.

What We Like

- Educational resources available in all plans—including resources for seniors

- Digital Footprint service

- Comprehensive cybersecurity options (in top-tier plan only)

What We Don’t Like

- Stolen funds reimbursement only in top-tier plan

- No address change monitoring in the basic plan

- No unique family plan features

- No lost wallet protection in the essential plan level

- No personal expense reimbursement in lower two levels

- $2 million coverage only in the top-tier family plan (for up to 10 people)

Pricing

Allstate offers three membership tiers for both individuals and families: Essentials, Premier, and Blue. The top-tier plan, Blue, is a new plan option that combines cyber and identity protection. Here are the payment breakdowns for the first year.

Individual Plans:

- Essentials $9.07/month paid annually ($9.99/month paid monthly)

- Premier $16.49/month paid annually ($17.99/month paid monthly)

- Cyber $15.83/month paid annually ($19.00/month paid monthly)

Family Plans:

- Essentials $16.49/month paid annually ($18.99/month paid monthly)

- Premier $32.08/month paid annually ($34.99/month paid monthly)

- Cyber $30.00/month paid annually ($36.00/month paid monthly)

Bottom Line

Allstate offers decent identity theft protection service plans—but the Essentials plan lacks some 'essential' features. That said, the dedicated Elder Fraud Center might make it worthwhile for senior clients.

Visit Allstate Website

Specs

- Dark Web Monitoring Yes

- Credit Monitoring No

- Data Breach Alerts Yes

- Max Coverage $2 million

- Individual Monthly Plans Starting at $6.25

- Family Monthly Plans Starting at $12.08

- Free Trial No

Summary

Zander’s coverage price is one of the lowest in the identity theft protection space, which is just one reason it's backed by financial guru Dave Ramsey.

Some of their coverage benefits include:

- Change of address monitoring

- Home title monitoring

- Lost wallet service

- Dark web monitoring

- Child monitoring

Considering the low price, this coverage is fairly comprehensive. Perhaps the most attractive feature is the extended benefits for adult dependents. Most family identity theft protection plans stop offering child benefits when they turn 18, but Zander extends restoration and recovery (not monitoring) features until they are 26.

Members can also choose to bundle their identity theft packages with a digital protection plan for a few more dollars a month. This elite package adds an Experian CreditLock, premium VPN, and new account monitoring on 10 devices (20 with the family plan).

Regarding identity restoration, Zander offers 24/7/365 recovery services with a dedicated specialist and up to $1 million in reimbursements ($2 million for families). It also provides unlimited restoration services.

The most significant drawback, however, is that Zander doesn't offer any credit or bank monitoring. Instead, it encourages people to use the free versions with credit bureaus or their own financial institutions. However, considering credit bureau scams made the top-three identity theft list in 2022, the free versions are often not enough.

What We Like

- Recovery and customer assistance 24/7/365

- Affordable individual and family plans

- Unlimited recovery services

- Cybersecurity bundle option

What We Don’t Like

- Credit monitoring unavailable

- No bank or credit card monitoring

- No free trial

- No 401k or investment monitoring

- No social media monitoring

- Familial benefits limited to child monitoring and added device protection

Pricing

Zander offers two tiers of individual and family plans: an Essential Plan and an Elite Cyber Bundle. The latter combines identity and cybersecurity protection features.

Individual Plans:

- Essential $6.25/month paid annually ($6.75/month paid monthly)

- Elite Cyber Bundle $9.17/month paid annually ($9.99/month paid monthly)

Family Plans:

- Essential $12.08/month paid annually ($12.90/month paid monthly)

- Elite Cyber Bundle $17.92/month paid annually ($19.49/month paid monthly)

Bottom Line

Zander is a solid option if affordability is a priority. However, the price represents its limited features since the plans lack several essential features, like credit and bank monitoring.

Visit Zander ID Protection Website

Specs

- Dark Web Monitoring Yes

- Credit Monitoring No

- Data Breach Alerts Yes

- Max Coverage $1 million

- Individual Monthly Plans Starting at $19.25

- Family Monthly Plans No

- Free Trial No

Summary

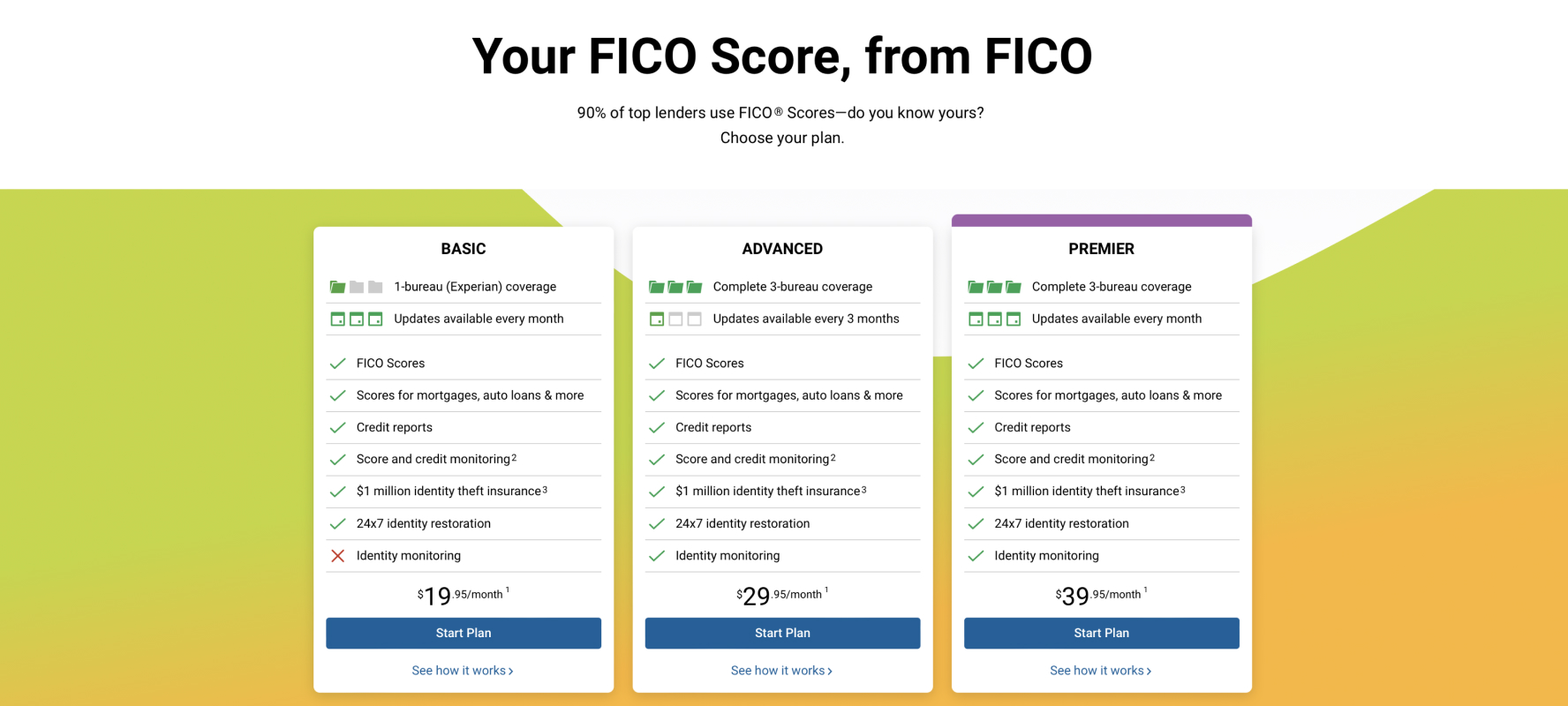

myFICO is a division of the Fair Isaac Corporation (FICO), a data analytics company that produces the most commonly used score when determining creditworthiness: the FICO credit score.

With that background in credit scores, it only makes sense that myFICO also focuses on credit monitoring. All three plans include FICO Score monitoring and credit reports, plus 24/7 access to identity restoration experts.

Perhaps myFICO's best feature is its credit score simulator. It shows your potential credit score outcomes after certain actions, like taking out a loan or buying a house, which helps you thoroughly prepare before any major financial decision.

myFICO plans also include an education center to help you improve your credit and meet credit goals. The one downside of credit monitoring is that you only get one-bureau credit monitoring with the most basic plan. This plan also doesn't include any identity monitoring features, despite its $20 price tag.

Even the top-tier plans that do include identity monitoring lack essential features, like 401k, investment, and payday monitoring. The price increase is mostly justified by the additional credit monitoring reports, not extensive identity theft or family plan features.

What We Like

- Thorough credit monitoring and reporting

- FICO Score simulator and analysis

- Different credit scores for various needs

What We Don’t Like

- Lowest-tier plan lacks any identity monitoring

- Higher tier have limited identity monitoring features

- Despite focus on credit, basic plan includes one-bureau coverage

- Limited financial monitoring

- No family options

- Plans offer few services at a high price

Pricing

MyFico offers only individual plans—no family options or cybersecurity bundles. Here's a snapshot of the three plan levels:

- Basic $19.95/month

- Advanced $29.95/month

- Premier $39.95/month

Bottom Line

MyFico offers excellent credit monitoring plans but not much else. You can get much more comprehensive plans for the same—or lower—prices.

Visit myFico Website

Specs

- Dark Web Monitoring No

- Credit Monitoring Yes

- Data Breach Alerts No

- Max Coverage $1 million (with paid plan)

- Individual Monthly Plans Starting at $0

- Family Monthly Plans No

- Free Trial 7 days

Summary

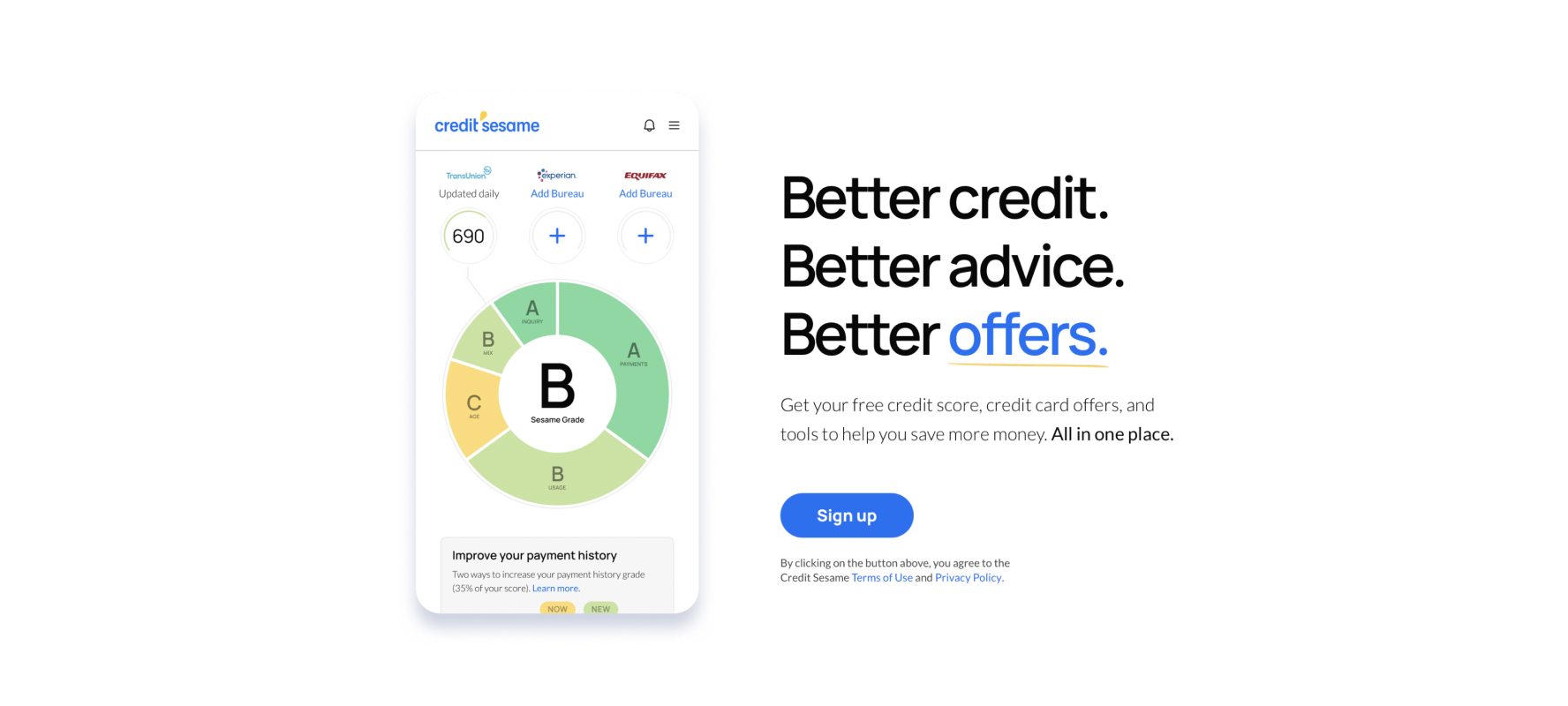

As a fairly new credit and loan company, Credit Sesame focuses on helping people monitor and improve their credit. With its popular free account, members get the following:

- Free on-bureau credit monitoring

- Monthly credit report

- Credit report analysis

- Credit-building tips and goals

For what it is, the free plan can be very insightful. However, there's no identity monitoring besides credit, and members have to pay for the premium account to get credit notifications, live support, and insurance.

Even with the paid premium plan, identity theft protection services are limited. It includes credit monitoring, advanced notifications and three-bureau credit reports, plus access to live support for a credit dispute. In the event of identity theft, premium members can get up to $1 million in coverage.

However, that's about it. All of the premium features focus on credit monitoring (aside from the white-glove theft restoration services), overlooking essential things like financial and identity monitoring.

It's also worth mentioning the heavy advertising provided under the guise of helping you build your credit. Your profile (free or premium) includes numerous offers for credit cards, insurance plans, and loans. It also promotes its own Sesame Cash feature, which requires additional monthly payments.

What We Like

- Free plan available

- Thorough credit monitoring and reporting—even in the free plan

- Tips on how to improve your credit score

What We Don’t Like

- No bank, social media, or investment monitoring

- Extremely limited identity theft protection services

- Financial monitoring limited to bankruptcy reports

- Heavy advertising through partner offers

- Cannot access the premium plan without starting a free account

- Added charges for Sesame Cash

Pricing

All Credit Sesame users must start with the free plan. Once they've set up an account, they can access the premium plan.

- Basic Free

- Premium $19.99/month

Not that there are added costs if you want to use Sesame Cash, including a $9.99 monthly fee and a $3 inactivity fee.

Bottom Line

Credit Sesame is a great resource to get free credit monitoring, but it comes with some obvious limitations. If you want to get in-depth, higher-quality coverage, you have to pay—and even then, the identity theft protection services are extremely limited.

Visit Credit Sesame Website